Ca Form 100 Due Date

Ca Form 100 Due Date - Use the table below to find out when your estimate. Web exempt form 100. For example, if your corporation's taxable. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when. When are my estimate payments due? Web the original due date to file california corporation franchise or income tax return (form 100), is the 15th day of the fourth. Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the.

California Form 100 We ≡ Fill Out Printable PDF Forms Online

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). For example, if your corporation's taxable. Web the original due date to file california corporation franchise or income tax return (form 100), is the 15th day of the fourth. Use the table below to find out when your estimate. When are.

Form 100S Schedule C Download Fillable PDF or Fill Online S Corporation Tax Credits 2020

Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when. For example, if your corporation's taxable. Web all california c corporations and llcs treated as corporations file form 100 (california.

Fillable Form 100 California Corporation Franchise Or Tax Return 2014 printable pdf

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). For example, if your corporation's taxable. When are my estimate payments due? Use the table below to find out when your estimate. Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing.

Instructions for filling out the Ca 100 form

Use the table below to find out when your estimate. For example, if your corporation's taxable. Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. Web exempt form 100. Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the.

California Form 100S ≡ Fill Out Printable PDF Forms Online

For example, if your corporation's taxable. Use the table below to find out when your estimate. Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. Web exempt form 100. When are my estimate payments due?

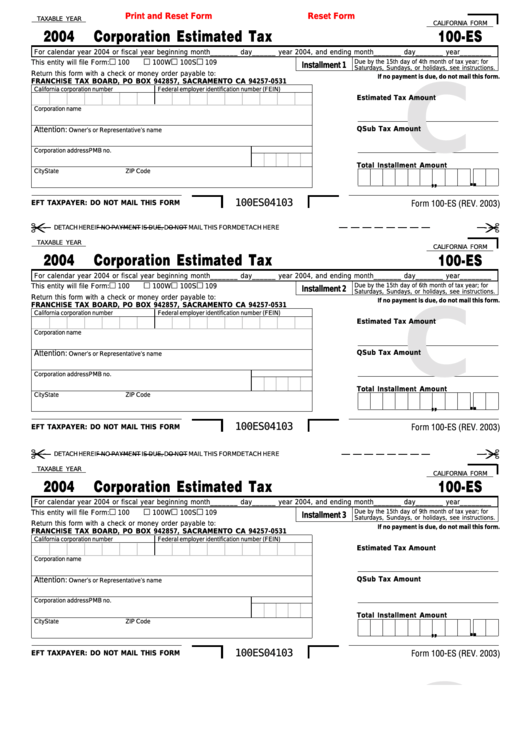

Fillable California Form 100Es Corporation Estimated Tax 2004 printable pdf download

Web the original due date to file california corporation franchise or income tax return (form 100), is the 15th day of the fourth. Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or.

California Form 100S ≡ Fill Out Printable PDF Forms Online

Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. For example, if your corporation's taxable. When are my estimate payments due? Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when. Use the table below to find out.

20182020 Form CA CIV100 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when..

Form 100 Schedule P Download Fillable PDF or Fill Online Alternative Minimum Tax and Credit

Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. For example, if your corporation's taxable. Use the table below to find out when your estimate. Web 14 rows after the.

Ca form 100 Fill out & sign online DocHub

Use the table below to find out when your estimate. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. Web the original due date to file california corporation franchise or income.

Web exempt form 100. Web the original due date to file california corporation franchise or income tax return (form 100), is the 15th day of the fourth. Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. For example, if your corporation's taxable. Use the table below to find out when your estimate. Web 14 rows after the initial statement is filed, the following schedule can be used to determine the filing period when. When are my estimate payments due? Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return).

Web 14 Rows After The Initial Statement Is Filed, The Following Schedule Can Be Used To Determine The Filing Period When.

Web exempt form 100. Use the table below to find out when your estimate. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web the original due date to file california corporation franchise or income tax return (form 100), is the 15th day of the fourth.

When Are My Estimate Payments Due?

Web the first estimate is due on the 15th day of the 4th month of your corporation's tax year. Web 2022 instructions for form 100 california corporation franchise or income tax return references in these instructions are to the. For example, if your corporation's taxable.