Cp503 Irs Form

Cp503 Irs Form - It explains your due date, amount due, and payment options. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Web irs notice cp503 is the 2nd notice of a balance due. Web received a cp503 notice from the irs? Web what you need to do. We’ll help you understand your tax. It is one of the most common notices that the irs sends out to. Pay online or mail a check or money. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated.

Understanding your CP503 Notice

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. It is one of the most common notices that the irs sends out to. Web received a cp503 notice from the irs? Web what you need to do. Pay online or mail a check or money.

Understanding IRS Collections Notices. CP501, CP503, and CP504 YouTube

Pay online or mail a check or money. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. We’ll help you understand your tax. Learn how to respond effectively, explore payment options, and. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year.

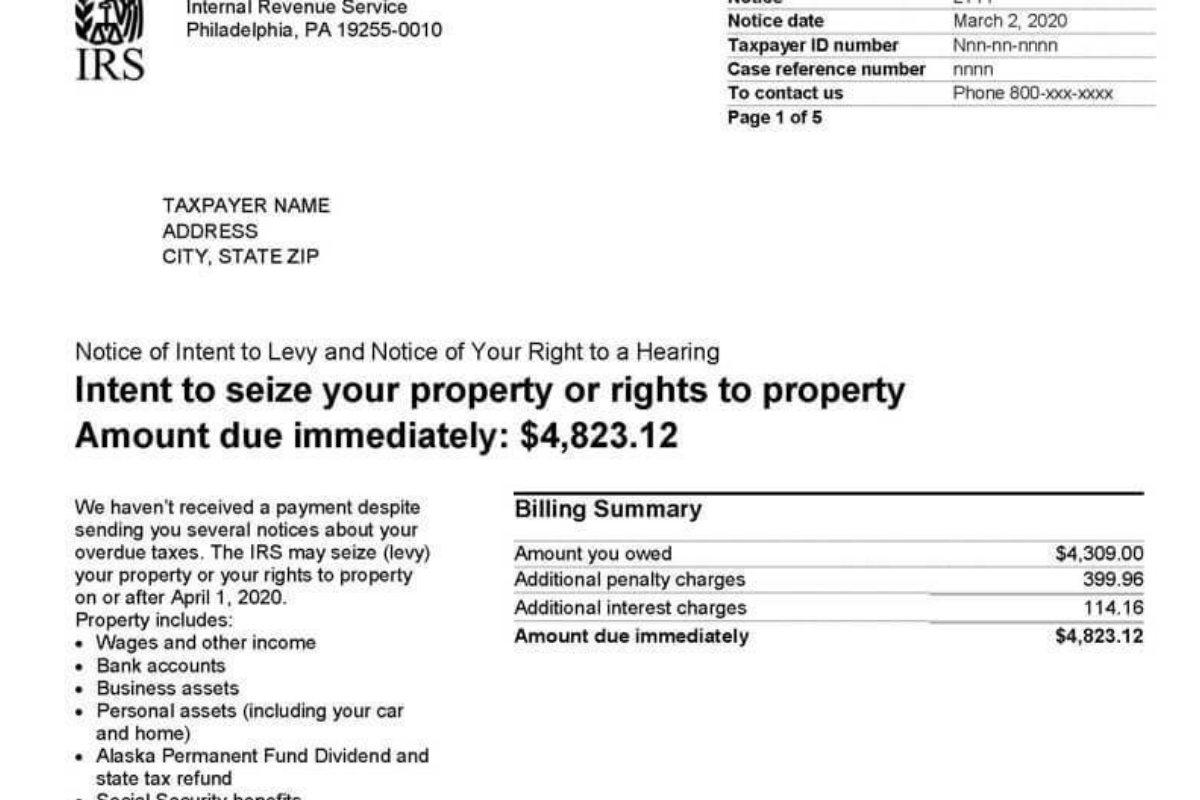

IRS Audit Letter CP503 Sample 1

Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Pay online or mail a check or money. Web received a cp503 notice from the irs? Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Web taxpayers receive irs.

IRS Resumes Collection Letters CP501 CP503 CP504 YouTube

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Pay online or mail a check or money. It explains your due date, amount due, and.

IRS Form 8919 ≡ Fill Out Printable PDF Forms Online

Pay online or mail a check or money. Learn how to respond effectively, explore payment options, and. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web what you need to do. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year.

IRS Form 501(c)(3) Definition Finance Strategists

It explains your due date, amount due, and payment options. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Web what you need to do. Pay online or mail a check or money. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income.

IRS Form 3520 ≡ Fill Out Printable PDF Forms Online

Pay online or mail a check or money. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Learn how to respond effectively, explore payment options, and. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Web.

IRS Notice CP503 Second Reminder for Unpaid Taxes H&R Block

It is one of the most common notices that the irs sends out to. Learn how to respond effectively, explore payment options, and. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. We’ll help you understand your tax. Web irs notice cp503 is the 2nd notice.

IRS Audit Letter CP503 Sample 1

Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. It is one of the most common notices that the irs sends out to. Web what you need to do. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Web irs notice cp503 is the.

NUMBER CRUNCHER LLC on Twitter "What do the IRS letters mean? Read today's blog post to find

Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. It is one of the most common notices that the irs sends out to. Web irs notice cp503 is the 2nd notice of a balance due..

We’ll help you understand your tax. Learn how to respond effectively, explore payment options, and. Web received a cp503 notice from the irs? Pay online or mail a check or money. Web what you need to do. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. It explains your due date, amount due, and payment options. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. It is one of the most common notices that the irs sends out to. Web irs notice cp503 is the 2nd notice of a balance due. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated.

It Explains Your Due Date, Amount Due, And Payment Options.

We’ll help you understand your tax. Learn how to respond effectively, explore payment options, and. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web what you need to do.

It Is One Of The Most Common Notices That The Irs Sends Out To.

Web irs notice cp503 is the 2nd notice of a balance due. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Pay online or mail a check or money. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges.

Web Received A Cp503 Notice From The Irs?

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you.