Dc-30 Form

Dc-30 Form - Generally, an unincorporated business, with gross income (line 11) more than. Unincorporated business franchise tax forms and instructions. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc.

Fillable Dc Tax Forms Printable Forms Free Online

Unincorporated business franchise tax forms and instructions. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Web effective 2/26/24, otr's cashier's office is now located.

OSC 3.0 Form [PDF Document]

Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Generally, an unincorporated business, with gross income (line 11) more than. Unincorporated business franchise tax forms and instructions. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web if.

VA Form 102850a Edit, Fill, Sign Online Handypdf

Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Unincorporated business franchise tax forms and instructions. Web if you have gross rents over $12,000 per year and you are.

DC30 CE&FDA Service Manual V16 DC32/DC30/DC28/DC26/DC Diagnostic Ultrasound System

Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Unincorporated business franchise tax forms and instructions. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Generally, an unincorporated business, with gross income (line 11) more than. Web if.

Form D30 Unincorporated Business Franchise Tax Return Government Of The District Of

Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Generally, an unincorporated business, with gross income (line 11) more than. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Unincorporated business franchise tax forms and instructions. Web dc.

Standard Horizon EDC30 Standard Horizon EDC30 DC Charging Adapter

Unincorporated business franchise tax forms and instructions. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Generally, an unincorporated business, with gross income (line 11) more than. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding.

Form Uc 30 ≡ Fill Out Printable PDF Forms Online

Generally, an unincorporated business, with gross income (line 11) more than. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Unincorporated business franchise tax forms and instructions. Web if.

Dc Tax 20152024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Unincorporated business franchise tax forms and instructions. Generally, an unincorporated business, with gross income (line 11) more than. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web if.

DC D30 Form 20192022 Fill out Tax Template Online US Legal Forms

Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Unincorporated business franchise tax forms and instructions. Generally, an unincorporated business, with gross income (line 11) more than. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web dc.

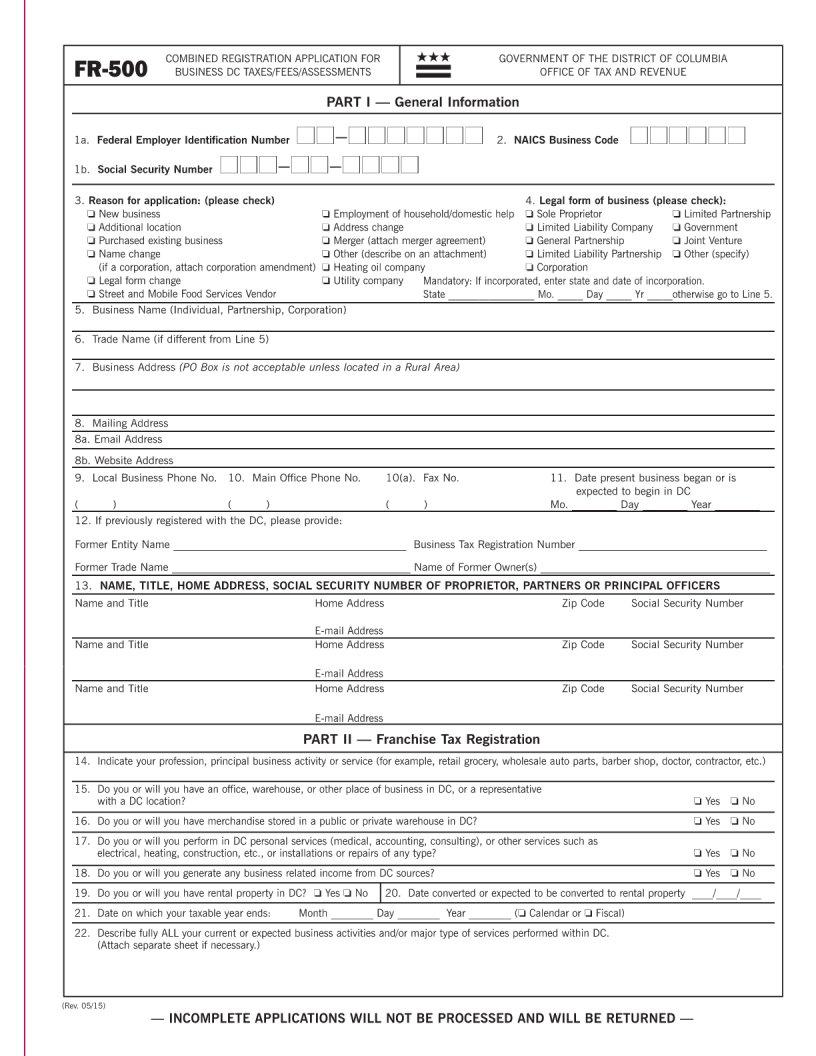

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Generally, an unincorporated business, with gross income (line 11) more than. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Web dc nonresidents are not required to file a.

Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc. Generally, an unincorporated business, with gross income (line 11) more than. Unincorporated business franchise tax forms and instructions.

Unincorporated Business Franchise Tax Forms And Instructions.

Generally, an unincorporated business, with gross income (line 11) more than. Web if you have gross rents over $12,000 per year and you are not a corporation, you are considered an unincorporated business. Web dc nonresidents are not required to file a dc tax return except to claim a refund of dc withholding or tax. Web effective 2/26/24, otr's cashier's office is now located at 1100 4th street, sw, suite e200, washington, dc.

![OSC 3.0 Form [PDF Document]](https://i2.wp.com/static.fdocuments.in/doc/1200x630/563db9f5550346aa9aa17316/osc-30-form.jpg?t=1681772263)