Federal Form 3800

Federal Form 3800 - Web form 3800 is used to compute and claim the general business credit for corporations. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. The general business credit (form 3800) is made up of many other credits, like: It includes sections for current year,. Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with.

Download Instructions for IRS Form 3800 General Business Credit PDF, 2022 Templateroller

Web form 3800 is used to compute and claim the general business credit for corporations. Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web the general business credit (form.

IRS Form 3800 Instructions General Business Credit

Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. Web form 3800 is used to compute and claim the general business credit for corporations. Web information about form 3800, general business credit, including recent updates, related forms and instructions.

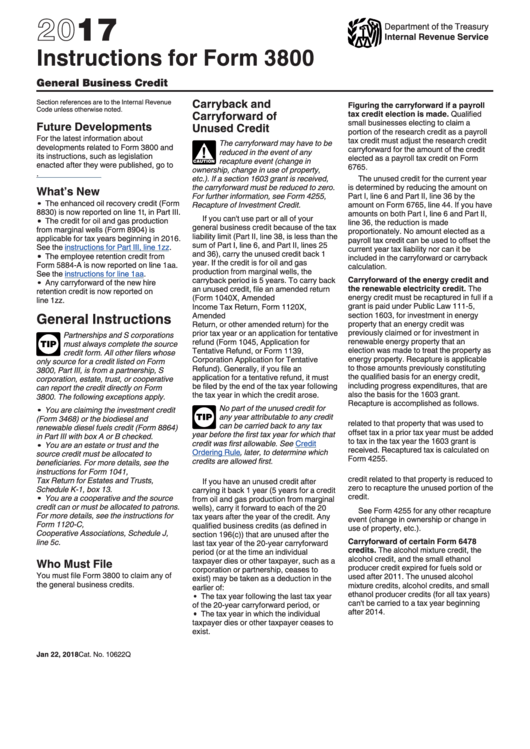

Instructions For Form 3800 General Business Credit 2017 printable pdf download

Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. Web form 3800 is used to compute and claim the general.

Download Instructions for IRS Form 3800 General Business Credit PDF, 2019 Templateroller

Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. It includes sections for current year,. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web form 3800 is used.

Download Instructions for IRS Form 3800 General Business Credit PDF, 2019 Templateroller

Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. It includes sections for current year,. Web if you claim multiple business tax credits on your tax return, you must attach form.

Instructions For Form 3800 General Business Credit Internal Revenue Service 2001 printable

Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. Web form 3800 is used to compute and claim the general business credit for corporations. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web the general business credit (form.

Download Instructions for IRS Form 3800 General Business Credit PDF, 2023 Templateroller

Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. It includes sections for current year,. Web form 3800 is used to compute and claim the general business credit for corporations. Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. Web.

Form 3800 Instructions

Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. The general business credit (form 3800) is made up of many other credits, like: Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to.

Form 3800 Instructions A Comprehensive Look for Beginners

Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. It includes sections for current year,. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. Web if you claim multiple business.

Form 3800 Fill out & sign online DocHub

The general business credit (form 3800) is made up of many other credits, like: Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. It includes sections for current year,. Web if you claim multiple business tax credits on your.

Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. The general business credit (form 3800) is made up of many other credits, like: Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back. It includes sections for current year,. Web form 3800 is used to compute and claim the general business credit for corporations. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business. Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with.

The General Business Credit (Form 3800) Is Made Up Of Many Other Credits, Like:

Web the general business credit (form 3800) is used to accumulate all of the business tax credits you are applying for in a specific tax year, to come up with. Web form 3800 is used to compute and claim the general business credit for corporations. Web information about form 3800, general business credit, including recent updates, related forms and instructions on how to. Web if you claim multiple business tax credits on your tax return, you must attach form 3800, general business.

It Includes Sections For Current Year,.

Web irs form 3800 allows you to claim general business credits on your tax return, including those you’ve carried back.