Form 8826 Instructions

Form 8826 Instructions - Web eligible small businesses use form 8826 to claim the disabled access credit. Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. This credit is part of the general business credit. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. How to take advantage of this credit on irs form 8826. Web irs form 8826 walkthrough (disabled access credit) teach me! In this article, we’ll walk through the disability tax credit, including: Instead, it must be figured on form. Web general instructions what’s new c the tax liability limit is no longer figured on this form;

Form 8826 Disabled Access Credit Form (2013) Free Download

In this article, we’ll walk through the disability tax credit, including: Web irs form 8826 walkthrough (disabled access credit) teach me! Instead, it must be figured on form. Web general instructions what’s new c the tax liability limit is no longer figured on this form; Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim.

IRS Form 8820 Fill Out, Sign Online and Download Fillable PDF Templateroller

Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. Web eligible small businesses use form 8826 to claim the disabled access credit. Web irs form 8826 walkthrough (disabled access credit) teach me! Web learn how to claim the disabled access credit for eligible small businesses on form 8826. Web general instructions what’s new c.

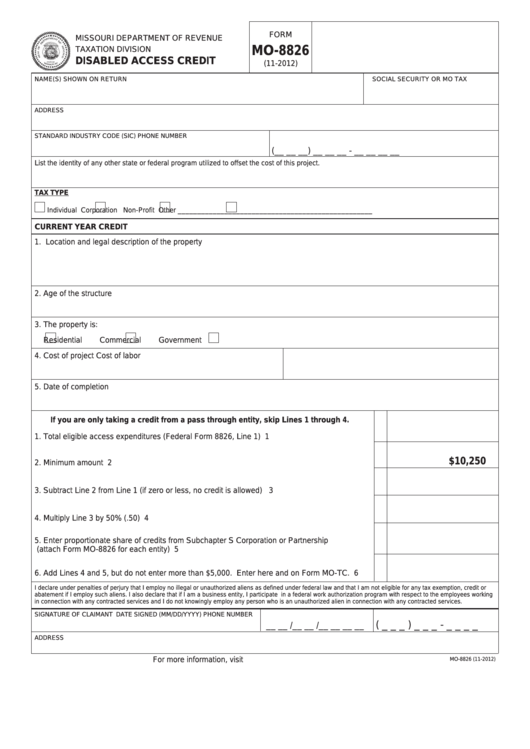

Fillable Form Mo8826 Disabled Access Credit printable pdf download

Web irs form 8826 walkthrough (disabled access credit) teach me! Web eligible small businesses use form 8826 to claim the disabled access credit. Web general instructions what’s new c the tax liability limit is no longer figured on this form; Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. How to take advantage of.

IRS Form 8826 Fill Out, Sign Online and Download Fillable PDF Templateroller

Instead, it must be figured on form. Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. Web eligible small businesses use form 8826 to claim the disabled access credit. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. How to take advantage of this credit on irs.

GORENJE BOP 8826 AX INSTALLATION INSTRUCTIONS MANUAL Pdf Download ManualsLib

Web general instructions what’s new c the tax liability limit is no longer figured on this form; Instead, it must be figured on form. Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. In this article, we’ll walk through the disability tax credit, including: This credit is part of the general business credit.

Tax Planning Teach Me! Personal Finance

Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. Web eligible small businesses use form 8826 to claim the disabled access credit. In this article, we’ll walk through the disability tax credit, including: This credit is part of.

Form MO8826 Fill Out, Sign Online and Download Fillable PDF, Missouri Templateroller

Web general instructions what’s new c the tax liability limit is no longer figured on this form; In this article, we’ll walk through the disability tax credit, including: Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. How to take advantage of this credit on irs form 8826. Web eligible small businesses use form.

Fillable Form 8826 Disabled Access Credit printable pdf download

This credit is part of the general business credit. Web eligible small businesses use form 8826 to claim the disabled access credit. Web general instructions what’s new c the tax liability limit is no longer figured on this form; In this article, we’ll walk through the disability tax credit, including: How to take advantage of this credit on irs form.

IRS Form 8826 Instructions Claiming the Disabled Access Credit

Web eligible small businesses use form 8826 to claim the disabled access credit. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. Web general instructions what’s new c the tax liability limit is no longer figured on this form; In this article, we’ll walk through the disability tax credit, including: How to take.

Fillable Form Ri8826 Rhode Island Disabled Access Credit 2013 printable pdf download

Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. How to take advantage of this credit on irs form 8826. Web irs form 8826 walkthrough (disabled access credit) teach me! Instead, it must be figured on form. Web general instructions what’s new c the tax liability limit is no longer figured on this form;

How to take advantage of this credit on irs form 8826. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. Web eligible small businesses use form 8826 to claim the disabled access credit. In this article, we’ll walk through the disability tax credit, including: Web irs form 8826 walkthrough (disabled access credit) teach me! Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. Instead, it must be figured on form. Web general instructions what’s new c the tax liability limit is no longer figured on this form; This credit is part of the general business credit.

How To Take Advantage Of This Credit On Irs Form 8826.

Web eligible small businesses use form 8826 to claim the disabled access credit. This credit is part of the general business credit. In this article, we’ll walk through the disability tax credit, including: Instead, it must be figured on form.

Web Irs Form 8826 Walkthrough (Disabled Access Credit) Teach Me!

Web refer to form 8826, disabled access credit (pdf), for instructions for how to claim. Web learn how to claim the disabled access credit for eligible small businesses on form 8826. Web general instructions what’s new c the tax liability limit is no longer figured on this form;