Form 8949 Codes

Form 8949 Codes - Use form 8949 to reconcile amounts that were. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web taxpayers use form 8949 to report sales and exchanges of capital assets. Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. For most transactions, you don't need to complete. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Web form 8949 is used to list all capital gain and loss transactions.

Form 8949 and Sch. D diagrams I did a cashless exercise with my nonqualified stock options last

For most transactions, you don't need to complete. Use form 8949 to reconcile amounts that were. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. Web anyone who sells or exchanges.

IRS Form 8949 Instructions

Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. Use form 8949 to reconcile amounts that were. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete.

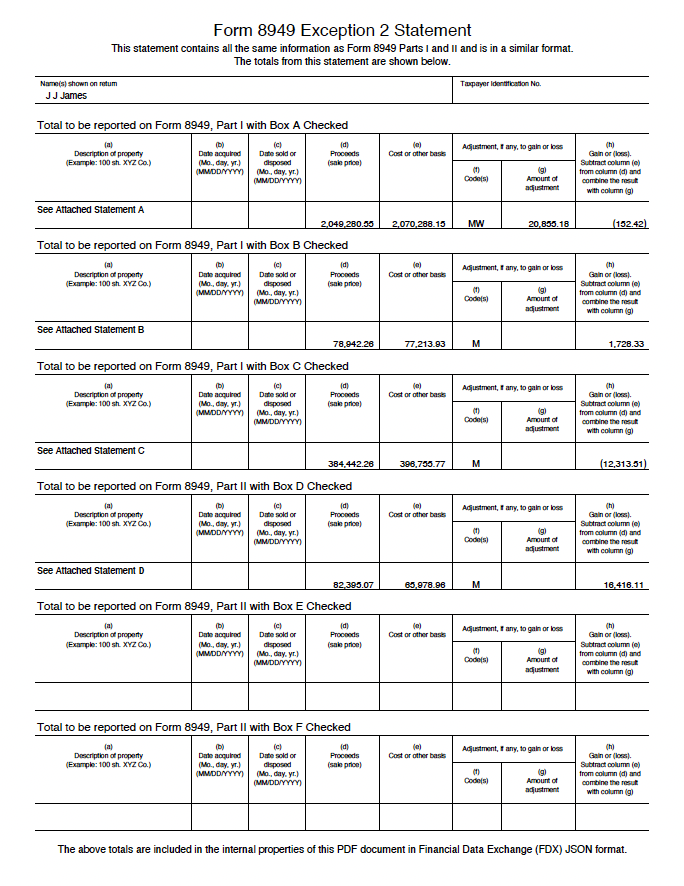

Explanation of IRS Form 8949 Exception 2

For most transactions, you don't need to complete. Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. Web form 8949 is used to list all capital gain and loss transactions. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web taxpayers use form.

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets

Use form 8949 to reconcile amounts that were. Web form 8949 is used to list all capital gain and loss transactions. Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real.

How to Import Intelligent Form 8949 Statements into Tax Software

Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web taxpayers use form 8949 to report sales and exchanges of capital assets. Use form 8949 to reconcile amounts that were. Web learn how to.

In the following Form 8949 example,the highlighted section below shows a W in column F

Web form 8949 is used to list all capital gain and loss transactions. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. For most transactions, you don't need.

IRS Form 8949 Instructions

Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. For most transactions, you don't need to complete. Web in this post, you'll learn key deadlines, filing instructions, and.

IRS Form 8949 Instructions

Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949..

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets

Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. Web form 8949 is used to list all capital gain and loss transactions. Web taxpayers use form 8949 to report sales and exchanges of capital assets. Web anyone who sells or exchanges a capital asset such as stock,.

Online Generation Of Schedule D And Form 8949 For 10 00 2021 Tax Forms 1040 Printable

Use form 8949 to reconcile amounts that were. Web form 8949 is used to list all capital gain and loss transactions. For most transactions, you don't need to complete. Web taxpayers use form 8949 to report sales and exchanges of capital assets. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form.

Web form 8949, titled sales and other dispositions of capital assets, is an irs tax form used by u.s. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Use form 8949 to reconcile amounts that were. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or. Web form 8949 is used to list all capital gain and loss transactions. Web taxpayers use form 8949 to report sales and exchanges of capital assets. For most transactions, you don't need to complete. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form.

Web Form 8949, Titled Sales And Other Dispositions Of Capital Assets, Is An Irs Tax Form Used By U.s.

Use form 8949 to reconcile amounts that were. Web form 8949 is used to list all capital gain and loss transactions. Web anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete form 8949. Web learn how to complete form 8949 to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or.

For Most Transactions, You Don't Need To Complete.

Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web taxpayers use form 8949 to report sales and exchanges of capital assets.