Iowa Homestead Tax Credit And Exemption Form

Iowa Homestead Tax Credit And Exemption Form - The department is excited to announce our. Families/households with more than 8 persons, add $11,800 for each additional person. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Return the form to your city or county assessor. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Web homestead tax credit and exemption. This tax credit continues as. Notice of transfer or change in use of property. Web the department recently announced through a news release the availability of the new homestead exemption.

Form 54028 Download Fillable PDF or Fill Online Homestead Tax Credit and Exemption, Iowa

Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. This tax credit continues as. The department is excited to announce our. Web homestead tax credit and exemption.

SC Application For Homestead Exemption Fill And Sign Printable

This tax credit continues as. The department is excited to announce our. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Web homestead tax credit and exemption.

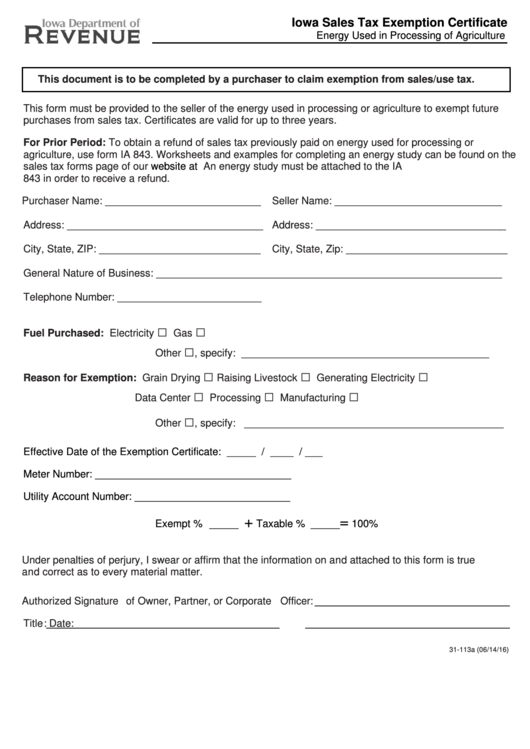

How To Get An Iowa Sales Tax Exemption Certificate StartUp 101

Families/households with more than 8 persons, add $11,800 for each additional person. Notice of transfer or change in use of property. Return the form to your city or county assessor. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. This tax credit continues as.

Homestead exemption form

The department is excited to announce our. Notice of transfer or change in use of property. Return the form to your city or county assessor. This tax credit continues as. Families/households with more than 8 persons, add $11,800 for each additional person.

Homestead Exemption Application for 65+ Cedar County, Iowa

Web homestead tax credit and exemption. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. This tax credit continues as. Notice of transfer or change in use of property. Return the form to your city or county assessor.

Application Form For Homestead Tax Credit printable pdf download

The department is excited to announce our. Return the form to your city or county assessor. This tax credit continues as. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Notice of transfer or change in use of property.

Application For Homestead Property Tax Exemption Form printable pdf download

Web the department recently announced through a news release the availability of the new homestead exemption. The department is excited to announce our. This tax credit continues as. Families/households with more than 8 persons, add $11,800 for each additional person. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value.

Form 54028 Download Fillable PDF or Fill Online Homestead Tax Credit and Exemption, Iowa

Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. This tax credit continues as. Web the department recently announced through a news release the availability of the new homestead exemption. Notice of transfer or change in use of property. Families/households with more than 8 persons, add $11,800 for each additional person.

Iowa sales tax exemption certificate Fill out & sign online DocHub

Families/households with more than 8 persons, add $11,800 for each additional person. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. The department is excited to announce our. Return the form to your city or county assessor. This tax credit continues as.

Iowa Sales Tax Exemption Certificate Form Iowa Department Of Revenue printable pdf download

Families/households with more than 8 persons, add $11,800 for each additional person. Return the form to your city or county assessor. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. The department is excited to announce our. Notice of transfer or change in use of property.

Return the form to your city or county assessor. Notice of transfer or change in use of property. Web homestead tax credit and exemption. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Families/households with more than 8 persons, add $11,800 for each additional person. This tax credit continues as. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Web the department recently announced through a news release the availability of the new homestead exemption. The department is excited to announce our.

Iowa Code Chapter 425 And Iowa Administrative Code Rule 701—110.1 This Application.

Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Web the department recently announced through a news release the availability of the new homestead exemption. Web homestead tax credit and exemption. Families/households with more than 8 persons, add $11,800 for each additional person.

Notice Of Transfer Or Change In Use Of Property.

Return the form to your city or county assessor. This tax credit continues as. The department is excited to announce our.