Kansas K-40 Form

Kansas K-40 Form - Enter the result here and on line 18 of this form Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Kansas law provides that if a husband or wife is a resident of. To file, you will complete the interview questions as they. Web food sales tax credit (multiply line g by $125). Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: 1) you are required to.

Fillable Form K40 Kansas Individual Tax 2013 printable pdf download

To file, you will complete the interview questions as they. Kansas law provides that if a husband or wife is a resident of. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Web if you were a kansas resident for the entire year, you must file.

Fillable Form K40 Kansas Individual Tax Return 2015 printable pdf download

Enter the result here and on line 18 of this form Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Kansas law provides that if a husband or wife is a resident of. To file, you will complete the interview questions as they. 1) you are required to.

Form K40 Instructions Kansas Individual Tax And/or Food Sales Tax Refund printable pdf

Kansas law provides that if a husband or wife is a resident of. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Enter the result here and on line 18 of this form Web if you were a kansas resident for the entire year, you must.

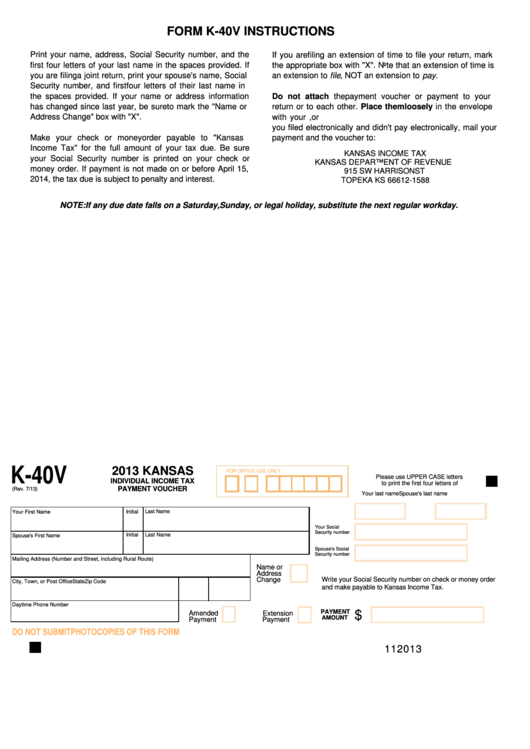

Form K40V Download Fillable PDF or Fill Online Kansas Individual Tax Payment Voucher

To file, you will complete the interview questions as they. Kansas law provides that if a husband or wife is a resident of. Enter the result here and on line 18 of this form 1) you are required to. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount.

Form K40C Fill Out, Sign Online and Download Fillable PDF, Kansas Templateroller

1) you are required to. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. To file, you will complete the interview questions as they. Web food sales tax credit (multiply line g by $125). Kansas law provides that if a husband or wife is a resident.

Printable Kansas Tax Forms Printable Forms Free Online

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Enter the result here and on line 18 of this form Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Web food sales tax credit.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank PDFfiller

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Kansas law provides that if a husband or wife is a resident of. Web food sales tax credit (multiply line g by $125). Enter the result here and on line 18 of this form To file, you will complete.

Form K40H Download Fillable PDF or Fill Online Kansas Homestead Claim 2020 Kansas

Kansas law provides that if a husband or wife is a resident of. 1) you are required to. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Enter the result here and on line 18 of this form Web if you were a kansas resident for.

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012 printable pdf download

Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: 1) you are required to. Web food sales tax credit (multiply line g by $125). Kansas.

Fillable Form K40h Kansas Homestead Claim 2015 printable pdf download

Enter the result here and on line 18 of this form Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web food sales tax credit (multiply line g by $125). To file, you will complete the interview questions as they. Kansas law provides that if a husband or.

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Enter the result here and on line 18 of this form Kansas law provides that if a husband or wife is a resident of. To file, you will complete the interview questions as they. Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total. 1) you are required to. Web food sales tax credit (multiply line g by $125).

Web Food Sales Tax Credit (Multiply Line G By $125).

Kansas law provides that if a husband or wife is a resident of. 1) you are required to. Enter the result here and on line 18 of this form To file, you will complete the interview questions as they.

Web If You Were A Kansas Resident For The Entire Year, You Must File A Kansas Individual Income Tax Return If:

Web you must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total.