Turbotax Form 5329

Turbotax Form 5329 - Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Learn how to file, what to report, and get the. The form is filled out and submitted by the. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web use form 5329 to report additional taxes on: Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2.

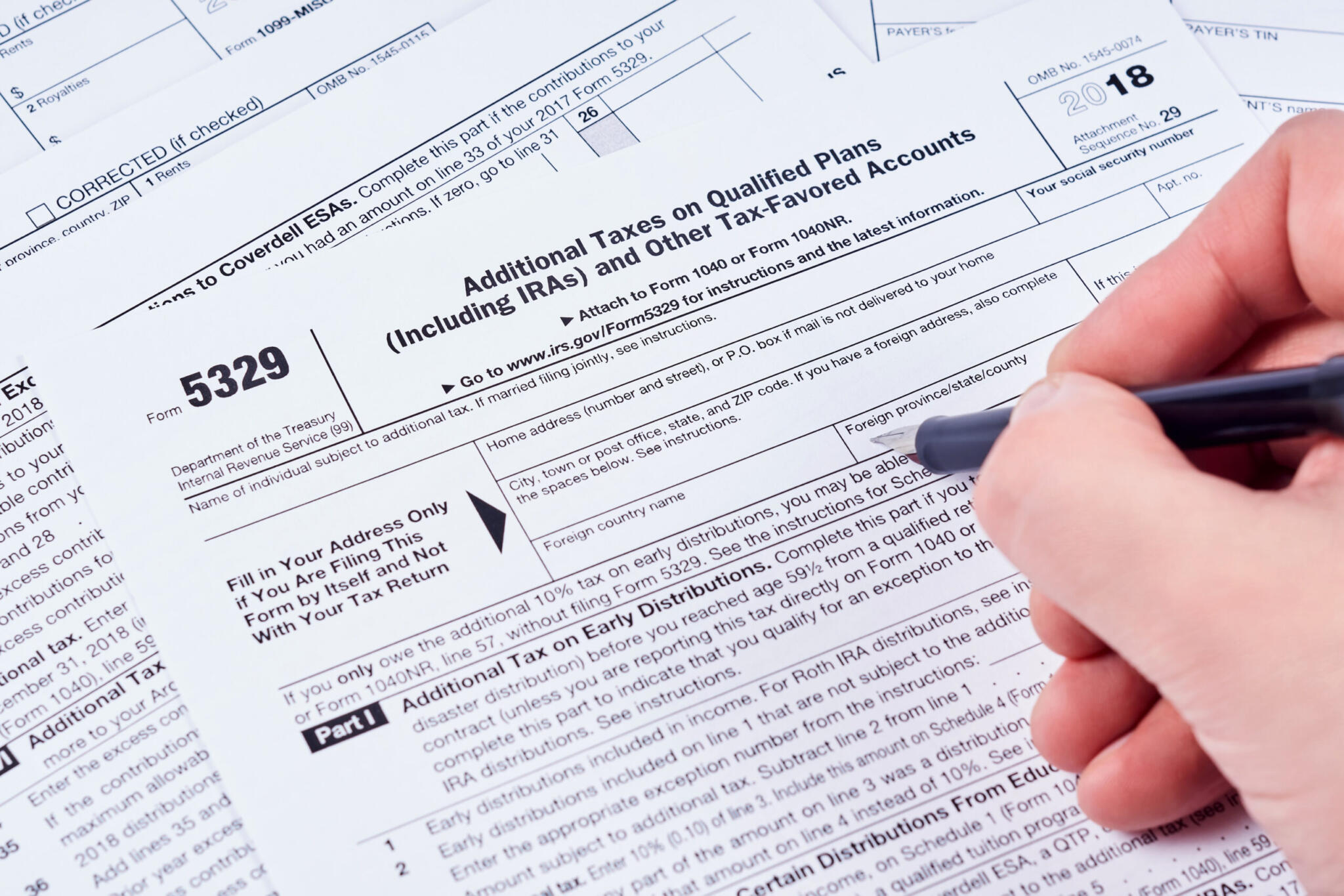

IRS Form 5329 Explained How to Navigate Retirement Account Penalty Exemptions?

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Learn how to file, what to report, and get the. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web the irs.

How can I edit form 5329? TurboTax doesn't have the correct values in it.

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web in this article, you'll find answers to frequently asked questions on.

Form 5329 turbotax Fill out & sign online DocHub

Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Learn how to file, what to report, and get the. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. The form.

Fill Free fillable Form 5329 2019 Additional Taxes on Qualified Plans PDF form

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web use form 5329 to report additional taxes on: The form is filled out and submitted by the. Learn how to.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Learn how to file, what to report, and get the. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. The form.

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on Qualified Plans

Learn how to file, what to report, and get the. Web use form 5329 to report additional taxes on: Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Iras, other.

Solved Where is the form 5329 on TurboTax?

Learn how to file, what to report, and get the. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web use form 5329 to report.

How do I include form 5329 when I efile with TurboTax? Page 2

Web use form 5329 to report additional taxes on: Learn how to file, what to report, and get the. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Iras, other.

5329 Additional Taxes on Qualified Plans UltimateTax Solution Center

Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web use form 5329 to report additional taxes on: Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Learn how to file, what to report,.

Instructions for How to Fill in IRS Form 5329

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Iras, other qualified retirement plans, modified endowment contracts, coverdell. The form is filled out and submitted by the. Learn how to file, what to report, and get the. Web in this article, you'll find answers to frequently asked questions.

The form is filled out and submitted by the. Learn how to file, what to report, and get the. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web use form 5329 to report additional taxes on: Iras, other qualified retirement plans, modified endowment contracts, coverdell.

Web Use Form 5329 To Report Additional Taxes On:

Learn how to file, what to report, and get the. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). The form is filled out and submitted by the. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other.

Web Complete This Part If You Took A Taxable Distribution (Other Than A Qualified Disaster Distribution) Before You Reached Age 591⁄2.

Iras, other qualified retirement plans, modified endowment contracts, coverdell.

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://i2.wp.com/help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-PIN-IRS-Form-5329.png)