Uci Tax Forms

Uci Tax Forms - If you’ve been instructed by the financial. Contact the tra team at. Learn about tax benefits for education, scholarships,. Web how can i obtain proof of uc retirement or income? Where do i locate tax forms? Web important tax information update: Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web find information and links to irs forms and publications for students at uci.

Does this mean I need to do taxes r/UCI

Web important tax information update: Where do i locate tax forms? If you’ve been instructed by the financial. Contact the tra team at. Web how can i obtain proof of uc retirement or income?

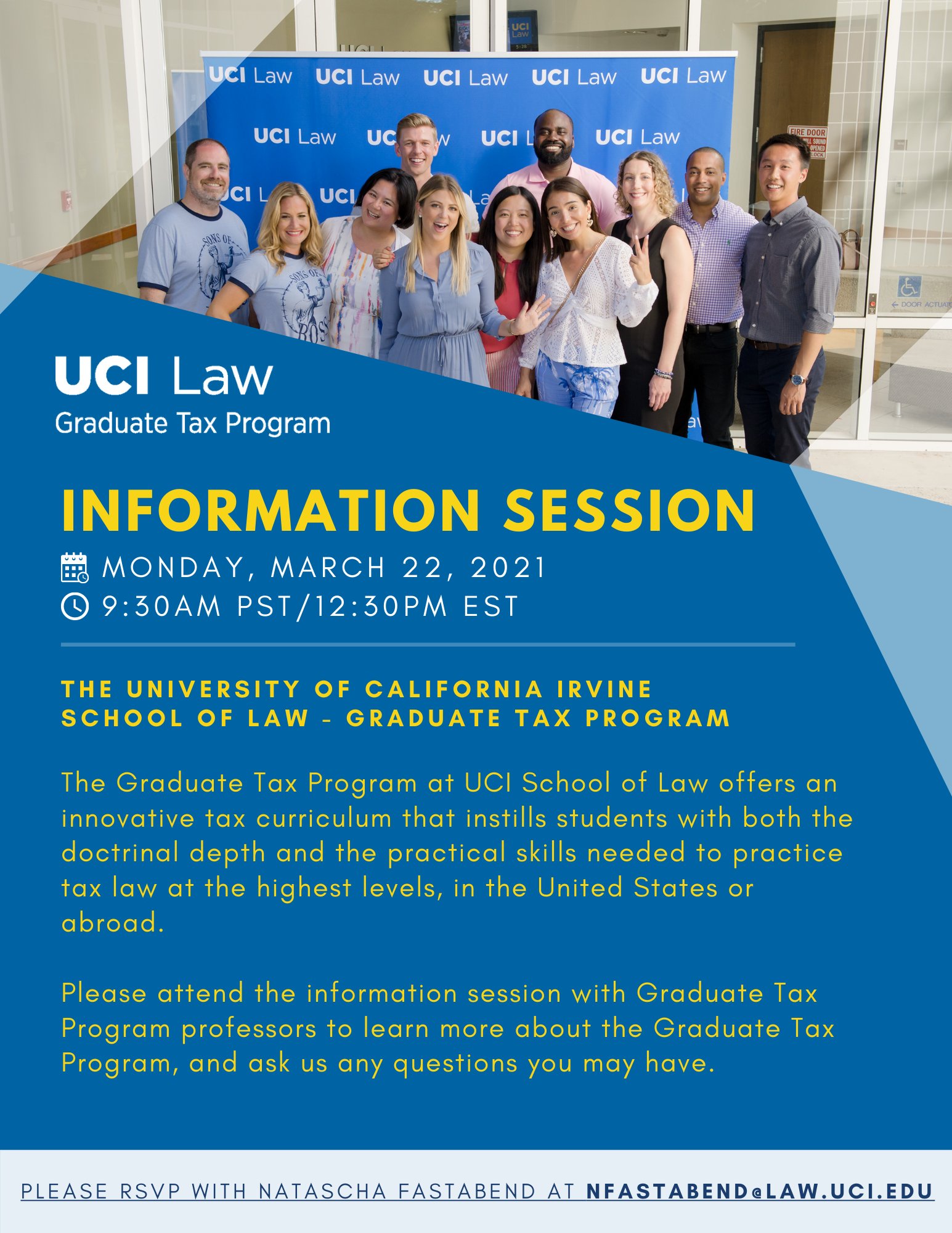

UCI Law Grad Tax on Twitter "Another opportunity to learn more about the UCILaw

Contact the tra team at. Where do i locate tax forms? Web how can i obtain proof of uc retirement or income? If you’ve been instructed by the financial. Learn about tax benefits for education, scholarships,.

Fresh Finances UCI Basic Needs Center

Web important tax information update: Learn about tax benefits for education, scholarships,. Contact the tra team at. If you’ve been instructed by the financial. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication.

W4 vs. W2 Forms What's the Difference and How to Use Them?

Where do i locate tax forms? Contact the tra team at. If you’ve been instructed by the financial. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web how can i obtain proof of uc retirement or income?

Fillable Online Forms and RegulationsPolitical Science UCI Fax Email Print pdfFiller

Where do i locate tax forms? If you’ve been instructed by the financial. Web find information and links to irs forms and publications for students at uci. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web important tax information update:

Uci Webreg Form Fill Out and Sign Printable PDF Template signNow

Where do i locate tax forms? Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Learn about tax benefits for education, scholarships,. Web find information and links to irs forms and publications for students at uci. Web how can i obtain proof of uc retirement or income?

California Tax Credits UCI Basic Needs Center

Learn about tax benefits for education, scholarships,. Web how can i obtain proof of uc retirement or income? Contact the tra team at. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. If you’ve been instructed by the financial.

California Tax Credits UCI Basic Needs Center

Web important tax information update: Contact the tra team at. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web find information and links to irs forms and publications for students at uci. If you’ve been instructed by the financial.

Fillable Online enrollment verification of family members uci form Fax Email Print pdfFiller

Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web how can i obtain proof of uc retirement or income? Contact the tra team at. Where do i locate tax forms? Web find information and links to irs forms and publications for students at uci.

Residency Documentation Examples Irvine Valley College

Learn about tax benefits for education, scholarships,. Contact the tra team at. Web find information and links to irs forms and publications for students at uci. Web how can i obtain proof of uc retirement or income? Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication.

Web how can i obtain proof of uc retirement or income? If you’ve been instructed by the financial. Where do i locate tax forms? Learn about tax benefits for education, scholarships,. Contact the tra team at. Web this important tax document will assist you in determining your eligibility for one of the tax benefits covered in irs publication. Web important tax information update: Web find information and links to irs forms and publications for students at uci.

Web How Can I Obtain Proof Of Uc Retirement Or Income?

If you’ve been instructed by the financial. Web find information and links to irs forms and publications for students at uci. Where do i locate tax forms? Learn about tax benefits for education, scholarships,.

Web This Important Tax Document Will Assist You In Determining Your Eligibility For One Of The Tax Benefits Covered In Irs Publication.

Web important tax information update: Contact the tra team at.