Form 1028 Michigan

Form 1028 Michigan - Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. The new michigan web account manager (miwam). Employer’s wage/tax reports must be filed online. Authorized by mcl 421.1 et seq. Web employer’s quarterly wage/tax report. Web there are two methods for taxing employers for unemployment insurance. Miwam and quarterly reporting, form 1028.

Fillable Form 1028 Annual Property Report 2012 printable pdf download

Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. Web employer’s quarterly wage/tax report. Web there are two methods for taxing employers for unemployment insurance. Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. The new michigan web account manager (miwam).

Fillable Form 1028 Application For Recognition Of Exemption printable pdf download

The new michigan web account manager (miwam). Web employer’s quarterly wage/tax report. Miwam and quarterly reporting, form 1028. Authorized by mcl 421.1 et seq. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your.

Form 1028 employment verification Fill out & sign online DocHub

Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. Authorized by mcl 421.1 et seq. Web employer’s quarterly wage/tax report. Employer’s wage/tax reports must be filed online. The new michigan web account manager (miwam).

Michigan Form 1028 ≡ Fill Out Printable PDF Forms Online

You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. Web there are two methods for taxing employers for unemployment insurance. Web employer’s quarterly wage/tax report. Miwam and quarterly reporting, form 1028. Employer’s wage/tax reports must be filed online.

Michigan Form 1028 ≡ Fill Out Printable PDF Forms Online

Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. Miwam and quarterly reporting, form 1028. Web there are two methods for taxing employers for unemployment.

Form 1028 Application for Recognition of Exemption under Section 521 of IRC (2006) Free Download

Employer’s wage/tax reports must be filed online. Miwam and quarterly reporting, form 1028. Authorized by mcl 421.1 et seq. Web employer’s quarterly wage/tax report. The new michigan web account manager (miwam).

Filing Your Quarterly Wage Report With UIA Michigan

Miwam and quarterly reporting, form 1028. Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and.

Uia 1028 Printable Form Printable Forms Free Online

Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. Web employer’s quarterly wage/tax report. Web there are two methods for taxing employers for unemployment insurance. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Employer’s wage/tax reports must be filed online.

Uia 1028 ≡ Fill Out Printable PDF Forms Online

Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. Miwam and quarterly reporting, form 1028. Web employer’s quarterly wage/tax report. Web there are two.

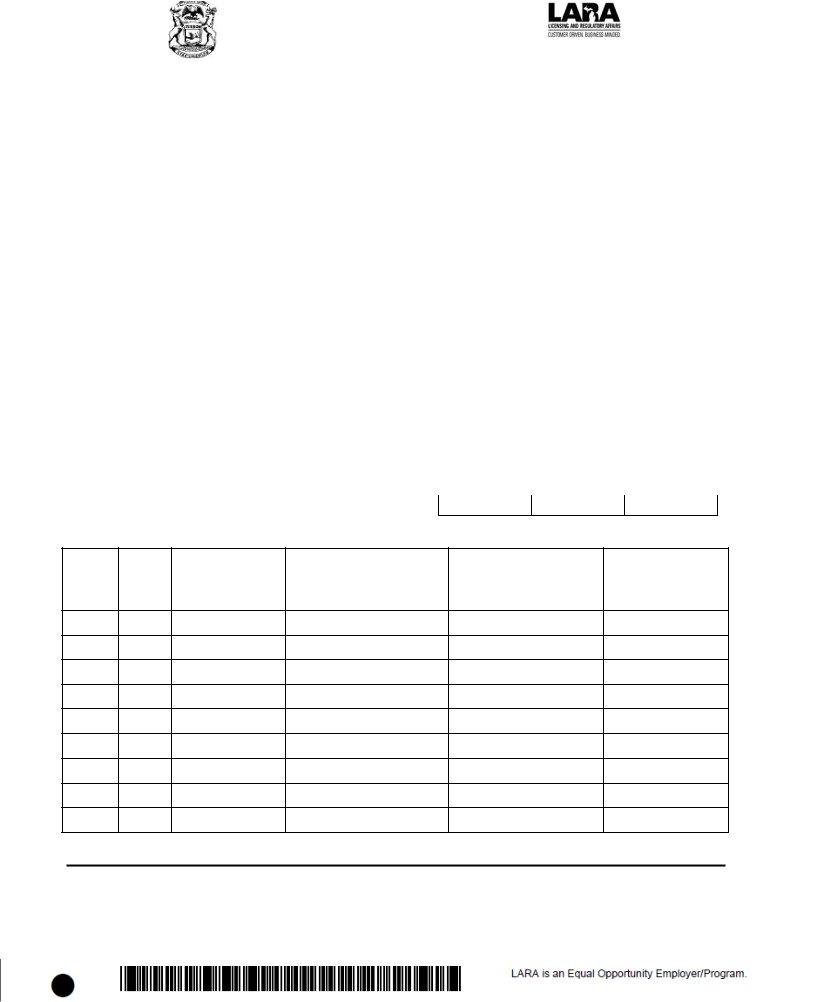

Fillable Form Uia 1028 Employer'S Quarterly Wage/tax Report Michigan Department Of Licensing

Web there are two methods for taxing employers for unemployment insurance. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Authorized by mcl 421.1 et seq. Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. Employer’s wage/tax reports must be filed online.

Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. Miwam and quarterly reporting, form 1028. Employer’s wage/tax reports must be filed online. Web there are two methods for taxing employers for unemployment insurance. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Web employer’s quarterly wage/tax report. Authorized by mcl 421.1 et seq. Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. The new michigan web account manager (miwam).

The New Michigan Web Account Manager (Miwam).

You must file an employer’s quarterly wage/tax report every quarter, even if you are unable to pay or have no payroll for the. Employer’s wage/tax reports must be filed online. Web michigan employment security (mes) act, (mcl 431.13) and administrative rule 421.121 of the. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your.

Web Employer’s Quarterly Wage/Tax Report.

Miwam and quarterly reporting, form 1028. Authorized by mcl 421.1 et seq. Web unemployment insurance agency employer’s quarterly wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax. Web there are two methods for taxing employers for unemployment insurance.